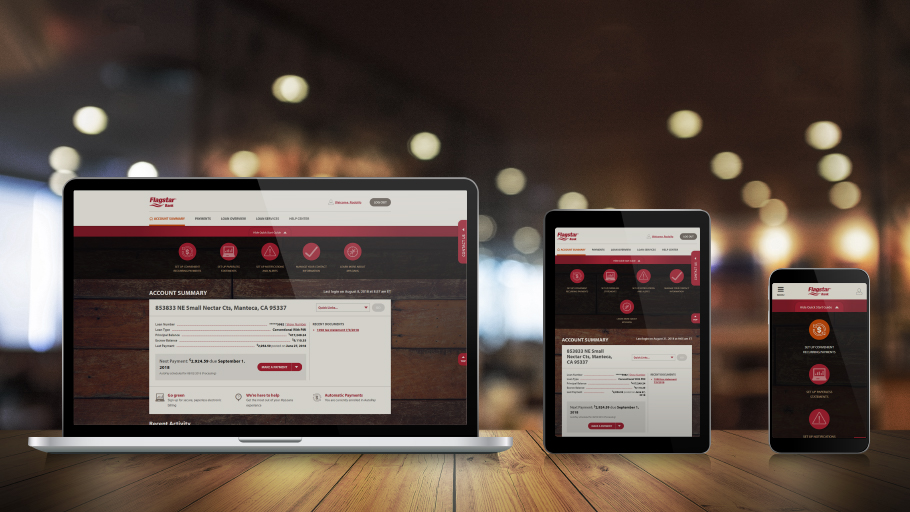

Manage Your Loans Online, Any Time With MyLoans.

Access MyLoans to make payments, view transaction history, review statements, and more.

What best describes you?

MyLoans features & benefits

- Convenient payment options including pay now, one-time future payments, or recurring payments

- View loan information such as due date, balances, interest rate, year-to-date interest and taxes

- Simple one-click setup to secure paperless statements

- Access a full history of your loan and escrow statements

- Create custom preferences, and set alerts and notifications

- User-friendly, responsive web and mobile experience available 24/7

Secure, fast, & easy payment options

1Making a payment online or by mail is a free service. You can also pay by phone, but please note an additional convenience fee of $15 may apply.

MyLoans Features & Benefits

- Convenient payment options including pay now, one-time future payments, or recurring payments

- View loan information such as due date, balances, interest rate, year-to-date interest and taxes

- Simple one-click setup to secure paperless statements

- Access a full history of your loan and escrow statements

- Create custom preferences, and set alerts and notifications

- User-friendly, responsive web and mobile experience available 24/7

What you need to know now

Your first billing statement will be mailed within 10 days of your loan being transferred. If you already had submitted a payment to your original servicer, don't worry - it will be automatically forwarded to First Commercial Bank for 30-60 days after your effective transfer date.

No need to worry about late fees or negative credit reporting: we won't charge a late fee nor will we make any negative reporting to the credit bureaus for 60 days following the effective date of your loan transfer.

Setup automatic payments online

Pay by mail

First Commercial Bank

Memorial City Mall

303 Memorial City Way, Houston, TX 77024

Pay by phone1

Pay at nearest branch

Mortgage servicing transfers occur when the servicing of a loan is sold or transferred from one institution to another. The terms of your loan do not change; however, First Commercial Bank will now collect your payments, manage escrow accounts, and provide customer service.

The sale and transfer of mortgages is common in the mortgage industry, and is in no way a direct reflection of you or the quality of your loan. The changes affecting you will be your loan number and payment address after the transfer date. You can look your new loan number up here, or find it on the welcome email or Notice of Transfer letter you received.

Please note: Due to the time it takes for systems to update from your previous servicer, your loan information will be recognized by our systems typically within 5 days after the transfer date. For exact timing, please see your Notice of Transfer letter, welcome email, or call +1(601) 282-9653.

If you currently have an escrow account for your tax and/or insurance payments, they will be transferred to First Commercial Bank and continue to be collected and paid. We typically run our escrow analyses annually based on your property tax payment schedule. Occasionally, the payment of taxes or insurance causes an adjustment in the escrow account balance, and it may be necessary to perform more than one analysis during the year.

No. If you currently have automatic payments set up with your previous servicer this service will be discontinued effective the date of transfer. Automatic payments are easy to set up when you sign up for MyLoans and enroll in AutoPay.

Ready to get started?

1Fannie Mae Star Award Performer 2015, 2016, 2017, 2018

2Making a payment online or by mail is a free service. You can also pay by phone, but please note an additional convenience fee of $15 may apply.